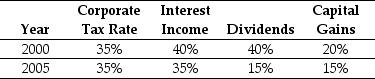

Use the table for the question(s) below.

Consider the following historical top federal tax rates in the United States:

Personal Tax Rates

-In 2005,assuming an average dividend payout ratio of 50%,the effective tax rate for equity holders was closest to:

Definitions:

Relationship Direction

Indicates whether the relationship between variables is positive, negative, or neutral, denoting the nature of the correlation.

True Score

A theoretical concept in measurement theory referring to the actual value of a variable or the accurate reflection of a construct being measured.

Measurement Error

The discrepancy between observed values and the true values, possibly due to inaccuracies or variability in measurement.

Pearson Product-moment

A statistical correlation coefficient expressed as a value between -1 and 1, indicating the degree to which two variables are linearly related.

Q2: Wyatt Oil has 25 million shares outstanding

Q6: Aquatic plants are rooted in a shallow

Q11: Suppose that to raise the funds for

Q30: Suppose that to raise the funds for

Q34: Which of the following statements is FALSE?<br>A)

Q42: Which of the following is not a

Q45: The initial value of MI's equity without

Q47: The cost of capital for a project

Q69: Which of the following statements is FALSE?<br>A)

Q92: Nielson Motors plans to issue 10-year bonds