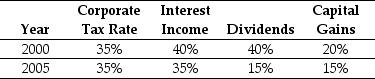

Use the table for the question(s) below.

Consider the following historical top federal tax rates in the United States:

Personal Tax Rates

-In 2005,assuming an average dividend payout ratio of 50%,the effective tax advantage for debt (τ*) was closest to:

Definitions:

Pure Monopoly

A market structure where a single seller controls the entire market for a product or service, with no close substitutes available.

Close Substitutes

Products or services that can easily replace each other in the eyes of the consumer, resulting in a high degree of interchangeability and competition.

Single Firm

A business or company that operates alone in its industry without competitors.

Purely Monopolistic

Characterizes a market scenario where one entity exclusively controls the entire market for a product or service, eliminating all direct competition.

Q3: Which of the following statements is FALSE?<br>A)

Q13: The unlevered beta for Lincoln is closest

Q14: If you take the job with Wyatt

Q23: The term ε is a(n):<br>A) measure of

Q43: Which of the following biomes has the

Q50: The NPV for Iota's new project is

Q53: The cost of capital for a project

Q56: What environmental factor makes it very difficult

Q68: The market portfolio:<br>A) is underpriced.<br>B) has a

Q94: Suppose you invest $15,000 in Merck stock