Use the following information to answer the question(s) below.

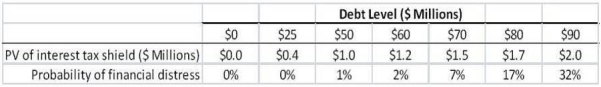

d'Anconia Copper is considering issuing one-year debt,and has come up with the following estimates of the value of the interest tax shield and the probability of distress for different levels of debt:

-If in the event of distress,the present value of distress costs is equal to $10 million,then the optimal level of debt for d'Anconia Copper is:

Definitions:

Incidental Damages

Additional expenses incurred by one party due to another's breach of contract, above and beyond the direct damages or loss suffered.

Swimsuits

Clothing designed for people to wear while swimming.

Credit

Credit is the ability to obtain goods or services before payment, based on the trust that payment will be made in the future.

Incidental Damages

Compensation for additional, unforeseen expenses incurred due to the breach of a contract or agreement.

Q1: The expected return on the alternative investment

Q4: Which of the following statements is FALSE?<br>A)

Q10: Which of the following is not a

Q19: The primary producers in terrestrial ecosystems are

Q29: The tendency of uninformed individuals to overestimate

Q39: Which would NOT be a characteristic of

Q40: The following equation: X = <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1624/.jpg"

Q40: Which of the following statements is FALSE?<br>A)

Q69: Rearden Metal has no debt,and maintains a

Q90: Consider the following equation: D<sup>t = d