Use the following information to answer the question(s) below.

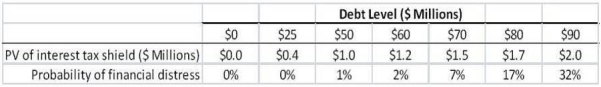

d'Anconia Copper is considering issuing one-year debt,and has come up with the following estimates of the value of the interest tax shield and the probability of distress for different levels of debt:

-If in the event of distress,the present value of distress costs is equal to $5 million,then the optimal level of debt for d'Anconia Copper is:

Definitions:

Structured Mission

A clearly defined and organized purpose or goal that directs the actions and strategies of an individual, group, or organization.

Legitimate

Refers to something that is lawful, justified, or recognized as being in accordance with established rules, principles, or standards.

Referent

An individual or group that someone relates to or identifies with, often used as a standard for comparison in social psychology.

Referent Power

A form of influence based on the leader's personal traits and the followers' identification with, attraction to, or admiration for the leader.

Q4: Introduction of alien or exotic species into

Q5: Which of the following statements is FALSE?<br>A)

Q9: Nielson Motors plans to issue 10-year bonds

Q17: Assuming that Tom wants to maintain the

Q27: Consider the following equation: r<sub>wacc</sub> = r<sub>U</sub>

Q31: The weight on Wyatt Oil stock in

Q33: The total of Rosewood's net income and

Q35: Which of the following statements is FALSE?<br>A)

Q44: Suppose that to raise the funds for

Q59: The unlevered cost of capital for "Moe"