Use the following information to answer the question(s) below.

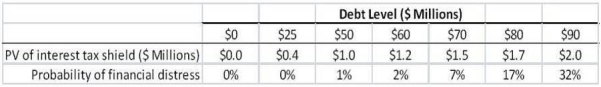

d'Anconia Copper is considering issuing one-year debt,and has come up with the following estimates of the value of the interest tax shield and the probability of distress for different levels of debt:

-If in the event of distress,the present value of distress costs is equal to $25 million,then the optimal level of debt for d'Anconia Copper is:

Definitions:

Society

A group of individuals involved in persistent social interaction, or a large social group sharing the same geographical or social territory, typically subject to the same political authority and dominant cultural expectations.

Respite Care

Temporary care provided to patients or clients, intended to give relief to their usual caregivers.

Caregivers

Caregivers are individuals who provide direct care and support to people with health-related needs or disabilities, including family members or professional health care providers.

Skilled Nursing Homes

Residential facilities that provide 24-hour medical care and supervision for individuals with chronic health conditions or recovering from illness or surgery.

Q2: Suppose that you are holding a market

Q5: Restoration ecology<br>A) Seeks to design reserves that

Q11: Which service provided by the natural biodiversity

Q27: Suppose that you borrow $30,000 in financing

Q49: Raceway Products has a market debt-to-equity ratio

Q49: Which of the following projects should Nielson

Q58: What is the expected payoff to debt

Q60: Suppose that you are holding a market

Q61: Assume that investors hold Google stock in

Q77: Which of the following statements is FALSE?<br>A)