Use the following information to answer the question(s) below.

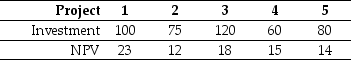

Nielson Motors has a debt-equity ratio of 1.8,an equity beta of 1.6,and a debt beta of 0.20.It is currently evaluating the following projects,none of which would change Nielson's volatility.  (All amounts are in $millions. )

(All amounts are in $millions. )

-The total debt overhang associated with accepting project 1 is closest to:

Definitions:

Compounded Semiannually

Refers to the process of calculating and adding interest to the principal balance of an investment or loan twice a year.

Strip Bond

A fixed-income security derived from the separation of the coupons from the principal of a bond, which are then sold separately as zero-coupon bonds.

Compounded Semiannually

A method of calculating interest where the accrued interest is added to the principal sum and interest is then calculated on the new total twice a year.

Monthly Compounded

Interest calculation in which the interest is added to the principal balance monthly, allowing earnings to increase at a faster rate compared to annual compounding.

Q20: Which of the following is NOT a

Q26: The _ biome is characterized by hot

Q42: Based upon the average EV/EBITDA ratio of

Q45: In the carbon cycle,carbon is returned to

Q50: Which of the following statements is NOT

Q62: Suppose that to raise the funds for

Q67: The weight on Taggart Transcontinental stock in

Q79: Which of the following statements is FALSE?<br>A)

Q89: Assume that to fund the investment Taggart

Q94: The market value of Luther's non-cash assets