Use the following information to answer the question(s) below.

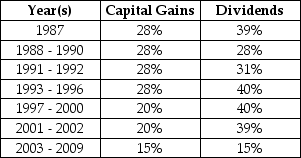

-In which years were dividends tax disadvantaged?

Definitions:

Stock Dividend

A form of dividend payment made in shares rather than cash, which increases the number of shares held by each shareholder.

Retained Earnings

The portion of a company's accumulated net income that is not distributed to shareholders as dividends but is kept as reserves for reinvestment in the business operations.

Stock Dividend

A payment made by a corporation to its shareholders in the form of additional shares, rather than cash.

Fair Value

An estimate of the price at which an asset could be bought or sold in a current transaction between willing parties, not in a forced or liquidation sale.

Q10: Which organisms provide most of the nutrient

Q10: Which of the following is not a

Q15: Another to method to repurchase shares is

Q20: If a project has a higher proportion

Q38: Nielson's EPS if they choose not to

Q39: The amount of money that Galt's fund

Q53: Assume that in the event of default,20%

Q56: There are two organisms with overlapping ranges

Q64: Why is a rocky sea shore inhabited

Q86: Which of the following statements is FALSE?<br>A)