Use the information for the question(s) below.

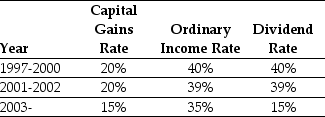

Consider the following tax rates:  *The current tax rates are set to expire in 2008 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

*The current tax rates are set to expire in 2008 unless Congress extends them.The tax rates shown are for financial assets held for one year.For assets held less than one year,capital gains are taxed at the ordinary income tax rate (currently 35% for the highest bracket) ;the same is true for dividends if the assets are held for less than 61 days.

-The effective dividend tax rate for a buy and hold individual investor in 2006 is closest to:

Definitions:

Theory of Evolution

A scientific explanation for the diversity of life on Earth, proposing that species change over time through processes such as natural selection.

Genes Influence

The impact that genetic makeup has on determining physical and behavioral traits in organisms.

Traits

Characteristics or attributes of an organism that are expressed by genes and/or influenced by the environment.

Genotypes

The genetic makeup of an organism, consisting of the alleles inherited from both parents that determine specific traits.

Q1: Assuming that Ideko has a EBITDA multiple

Q4: Which of the following statements is FALSE?<br>A)

Q7: Which of the following statements is FALSE?<br>A)

Q11: Tundra is divided into alpine tundra at

Q16: Which of the following statements is FALSE?<br>A)

Q39: An intimate relationship between two species in

Q39: Based upon the average P/E ratio of

Q41: If Rockwood finances their expansion by issuing

Q67: An African tropical grassland that varies cool,dry

Q78: Based upon the three comparable firms,calculate that