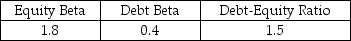

Use theUse the firm has only been listed on the stock exchange for a short time,you do not have an accurate assessment of Nielson's equity beta.However,you do have the following data for another firm in the same industry:  Nielson has a much lower debt-equity ratio of .5,which is expected to remain stable,and Nielson's debt is risk free.Nielson's corporate tax rate is 21%,the risk-free rate is 5%,and the expected return on the market portfolio is 10%.

Nielson has a much lower debt-equity ratio of .5,which is expected to remain stable,and Nielson's debt is risk free.Nielson's corporate tax rate is 21%,the risk-free rate is 5%,and the expected return on the market portfolio is 10%.

-Nielson's equity cost of capital is closest to:

Definitions:

Miller-Orr Model

The Miller-Orr Model is a financial model used to manage cash flow and determine the optimal balance between holding cash and investing in securities.

Opportunity Rate

The rate of return of a foregone investment compared to the potential return on the chosen investment.

Net Float

The difference between checks written against and deposited in an account, reflecting the time lag between writing a check and clearing it.

Available Balance

The amount of funds in an account that are accessible for withdrawal or use, considering any pending transactions.

Q6: Aquatic plants are rooted in a shallow

Q9: The weighted average cost of capital for

Q13: Based upon the average EV/Sales ratio of

Q37: Assume that investors in Google pay a

Q52: If Flagstaff currently maintains a debt to

Q57: The unlevered cost of capital for Anteater

Q76: Assume that management makes a surprise announcement

Q79: The total amount available to payout to

Q80: Anyone who purchases the stock on or

Q94: The market value of Luther's non-cash assets