Josh Drake died on May 1,2011.He left his entire estate,with a fair value of $6,200,000 to his sole surviving family member,his daughter,DeeDee.

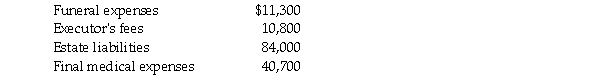

Prior to any distribution of assets,Josh's estate reflected the following details:

Required:

Required:

Calculate the federal estate tax on Mr.Drake's estate.You may ignore any state-level inheritance taxes and assume that the federal estate tax rate is 45%.

Definitions:

Par Value Bond

A financial instrument issued with a stated face value, the amount that will be paid back to the investor at maturity, not necessarily reflecting the bond's market value.

Yield

The income return on an investment, such as the interest or dividends received, expressed as an annual percentage of the investment's cost.

Coupon Rate

The rate of interest on a bond paid yearly, illustrated as a fraction of its par value.

Par Value

The face value of a bond or stock as stated by the issuer, which may differ from its market value. For bonds, it typically represents the amount to be repaid at maturity.

Q8: A foreign entity is a subsidiary of

Q13: A bankruptcy petition filed by a firm's

Q23: When sulfuric acid and calcium fluoride are

Q24: Ulysses Company purchases goods from China amounting

Q29: On September 1,2011,Bylin Company purchased merchandise from

Q33: On November 1,2011,Portsmith Corporation,a calendar-year U.S.corporation,invested in

Q34: The purchase price of an option contract

Q36: The Trasque Hospital is a nongovernmental,not-for-profit hospital.During

Q74: The compound 2-chloro-1-pentene<br>A) has the formula C<sub>5</sub>H<sub>11</sub>Cl.<br>B)

Q97: Write the equation for the production of