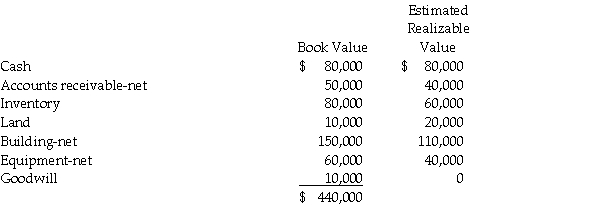

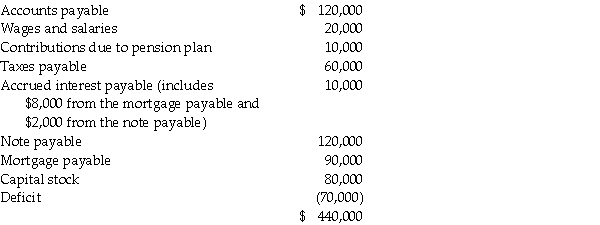

CommTex Corporation is liquidating under Chapter 7 of the Bankruptcy Act.The accounts of CommTex at the time of filing are summarized as follows:

The land and building are pledged as security for the mortgage payable as well as any accrued interest on the mortgage.The note payable is secured with the equipment,but the interest on the note is unsecured.Wages and salaries were earned within 90 days of filing the petition for bankruptcy and pension plan contributions relate to services rendered within 6 months of filing the petition for bankruptcy;neither exceeds $4,000 per employee.Liquidation expenses are expected to be $40,000.

The land and building are pledged as security for the mortgage payable as well as any accrued interest on the mortgage.The note payable is secured with the equipment,but the interest on the note is unsecured.Wages and salaries were earned within 90 days of filing the petition for bankruptcy and pension plan contributions relate to services rendered within 6 months of filing the petition for bankruptcy;neither exceeds $4,000 per employee.Liquidation expenses are expected to be $40,000.

Required:

1.Prepare a schedule showing the priority rankings of the creditors and the expected payouts.

2.Devendor Corporation was a supplier to CommTex Corporation and at the time of CommTex's bankruptcy filing,Devendor's account receivable from CommTex was $25,000.On the basis of the estimates,how much can Devendor expect to receive?

Definitions:

Regressive Tax

A tax system in which the tax rate decreases as the taxable amount increases, disproportionately burdening lower-income individuals.

Sales Tax

A tax imposed on sales of goods and services, typically calculated as a percentage of the selling price.

Tax Rate Structure

The system or design of tax rates, which can be progressive, regressive, or proportional, determining how taxes are applied based on income or other factors.

Marginal Tax Rate

The tax rate applied to the next dollar of income, indicating how much tax will be paid on an additional dollar of earnings.

Q7: How many different monochlorination products are formed

Q19: Prepare journal entries to record the following

Q20: In partnership liquidations,what are safe payments?<br>A)The amounts

Q21: Boron neutron capture therapy is used to

Q24: In a schedule of assumed loss absorptions<br>A)the

Q26: What is Pew's income from Sordid for

Q29: Paleo Corporation holds 80% of the capital

Q36: The Trasque Hospital is a nongovernmental,not-for-profit hospital.During

Q57: Which of the following reactants can

Q86: The nuclear binding energy for iron-56