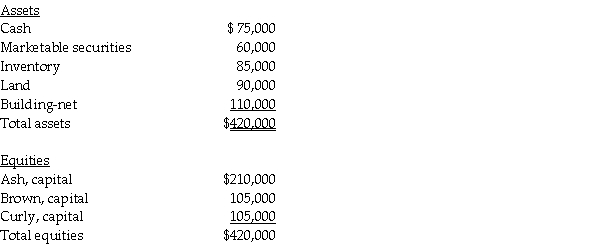

A summary balance sheet for the Ash,Brown,and Curly partnership on December 31,2011 is shown below.Partners Ash,Brown,and Curly allocate profit and loss in their respective ratios of 2:1:1.The partnership agreed to pay partner Brown $135,000 for his partnership interest upon his retirement from the partnership on January 1,2012.The partnership financials on January 1,2012 are:

Required:

Required:

Prepare the journal entry to reflect Brown's retirement from the partnership:

1.Assuming a bonus to Brown.

2.Assuming a revaluation of total partnership capital based on excess payment.

3.Assuming goodwill equal to the excess payment is recorded.

Definitions:

Present Value

The current worth of a future sum of money or stream of cash flows given a specified rate of return, used in evaluating investment opportunities.

Lease Receivable

An amount due to the lessor under a lease agreement, representing the lessor's right to receive payments from the lessee.

Manufacturer/Dealer Lessor

A party that leases out the goods they manufacture or deal in, providing customers with access to assets without transferring ownership.

Leased Receivable

An asset account that represents amounts owed by lessees to the owner of leased property, under the terms of lease agreements.

Q1: Powell Corporation acquired 90% of the voting

Q2: Peter Corporation owns 90% of the common

Q2: Push-down accounting<br>A)requires a subsidiary to use the

Q6: On January 1,2012,Pauline Company acquired 90% of

Q7: Bounty County had the following transactions in

Q11: Palmer Company owns a 25% interest in

Q14: What is the dollar amount of the

Q36: On July 1,2011,when Salaby Company's total stockholders'

Q77: For the compounds below, which statement is

Q128: Name the compound CH<sub>2</sub>=CHC(CH<sub>3</sub>)CH(CH<sub>3</sub>)<sub>2</sub>.