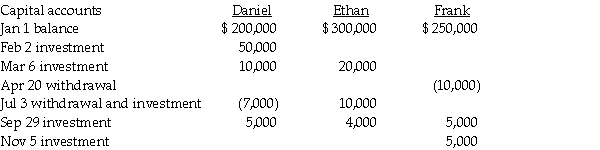

Daniel,Ethan,and Frank have a retail partnership business selling personal computers.The partners are allowed an interest allocation of 8% on their average capital.Capital account balances on the first day of each month are used in determining weighted average capital,regardless of additional partner investment or withdrawal transactions during any given month.Withdrawals of capital that are debited to the capital account are used in the average calculation.Partner capital activity for the year was:

Required:

Required:

Calculate weighted average capital for each partner,and determine the amount of interest that each partner will be allocated.Round all calculations to the nearest whole dollar.

Definitions:

Long-Term Debt

Financial obligations of a company that are due more than one year in the future, often used for significant projects or to purchase assets.

Debt-Equity Ratio

A ratio indicating a firm's financial leverage, determined by dividing its total debts by its shareholder equity.

Accounts Receivable Turnover

A financial ratio that measures how efficiently a company collects revenue from its customers by dividing total net credit sales by the average accounts receivable.

Net Working Capital

This is a measure of a company's liquidity, calculated as the difference between its current assets and current liabilities.

Q2: Static City started a department to provide

Q7: Bounty County had the following transactions in

Q14: On November 1,2010,the Yankee Corporation,a US corporation,purchased

Q16: For each of the following transactions that

Q22: Paroz Corporation acquired a 70% interest in

Q24: For a Voluntary Health and Welfare Organization,what

Q26: On January 1,2011,Singh Company acquired an 80

Q32: On January 1,2011,Singh Company acquired an 80

Q33: The financial statements of proprietary funds are

Q38: Proceeds from bonds issued for the construction