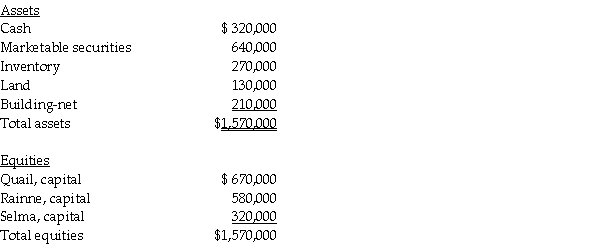

A summary balance sheet for the partnership of Quail,Rainne and Selma on December 31,2011 is shown below.Partners Quail,Rainne and Selma allocate profit and loss in their respective ratios of 6:3:1.

The partners agree to admit Trask for a one-tenth interest.The fair market value for partnership land is $260,000,and the fair market value of the inventory is $370,000.

The partners agree to admit Trask for a one-tenth interest.The fair market value for partnership land is $260,000,and the fair market value of the inventory is $370,000.

Required:

1.Record the entry to revalue the partnership assets prior to the admission of Trask.

2.Calculate how much Trask will have to invest to acquire a 10% interest.

3.Assume the partnership assets are not revalued.If Trask paid $300,000 to the partnership in exchange for a 10% interest,what would be the bonus that is allocated to each partner's capital account?

Definitions:

Elementary School

An initial stage of formal education for young children, typically including kindergarten through fifth or sixth grades, focusing on foundational subjects.

Sunni Muslim

Represents the largest branch of Islam, followers of which accept the first four caliphs as rightful successors to Prophet Muhammad.

Druze

A monotheistic religious and social community, originating in the Middle East, known for its unique blend of Islamic, Gnostic, and philosophical traditions.

Economic Loss

The financial diminution experienced by an individual or organization, typically due to business operations or economic conditions.

Q2: Rank the following claims of an organization

Q4: Bird Corporation has several subsidiaries that are

Q5: The exchange rates between the Australian dollar

Q12: General Hospital is a private,not-for-profit hospital.The following

Q14: Centralized data processing,central motor pools and garages,centralized

Q16: When a cash flow hedge is appropriate,the

Q22: Paroz Corporation acquired a 70% interest in

Q32: Leotronix Corporation estimates its income by calendar

Q32: Prepare journal entries to record the following

Q106: The primary structure of a peptide is