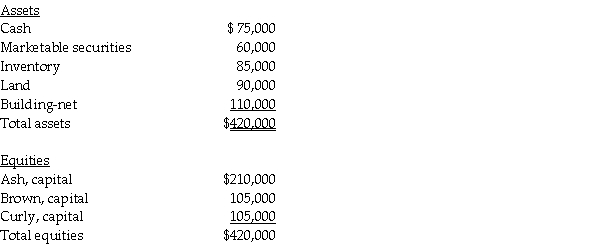

A summary balance sheet for the Ash,Brown,and Curly partnership on December 31,2011 is shown below.Partners Ash,Brown,and Curly allocate profit and loss in their respective ratios of 2:1:1.The partnership agreed to pay partner Brown $135,000 for his partnership interest upon his retirement from the partnership on January 1,2012.The partnership financials on January 1,2012 are:

Required:

Required:

Prepare the journal entry to reflect Brown's retirement from the partnership:

1.Assuming a bonus to Brown.

2.Assuming a revaluation of total partnership capital based on excess payment.

3.Assuming goodwill equal to the excess payment is recorded.

Definitions:

Stock Dividends

A payment to shareholders in the form of additional shares of stock rather than cash.

Paid-in Capital

Funds raised by a company through the sale of its equity securities, excluding any par value of the shares.

Retained Earnings

The portion of net earnings not distributed as dividends to shareholders but retained by the company for reinvestment or debt payment.

Stock Dividend

A dividend payment made in the form of additional shares rather than a cash payout, increasing the total number of shares owned.

Q4: At December 31,2010,the stockholders' equity of Gost

Q12: Oscar Lloyd is serving as the executor

Q20: Gains or losses on foreign currency transactions

Q20: On January 1,2012,Packaging International purchased 90% of

Q25: A U.S.importer that purchased merchandise from a

Q27: Pallet Corporation owns 80% of Adelt Corporation

Q34: An enterprise fund collects $100,000 cash for

Q94: What reactants would be used to synthesize

Q130: Predict the product of the reaction of

Q185: Which of the following monomers is used