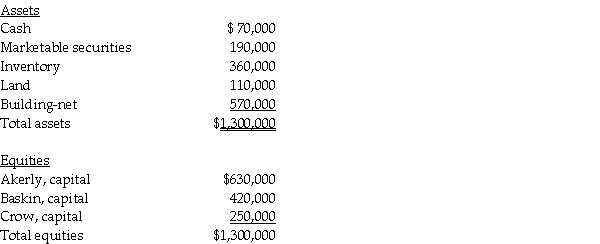

A summary balance sheet for the Akerly,Baskin,and Crow partnership on December 31,2011 is shown below.Partners Akerly,Baskin,and Crow allocate profit and loss in their respective ratios of 3:2:1.The partnership agreed to pay partner Baskin $500,000 for his partnership interest upon his retirement from the partnership on January 1,2012.The partnership financials on January 1,2012 are:

Required:

Required:

Prepare the journal entry to reflect Baskin's retirement from the partnership:

1.Assuming a bonus to Baskin.

2.Assuming a revaluation of total partnership capital based on excess payment.

3.Assuming goodwill equal to the excess payment is recorded.

Definitions:

Axons

Threadlike structures of neurons that transmit electrical impulses away from the neuron's cell body.

Differentiation

The process of becoming distinct or specialized in structure or function, or the mathematical process of finding a derivative.

Visual Preferences

The tendency to favor certain visual stimuli over others, often influenced by factors such as novelty, movement, and color.

Failure To Thrive

A condition seen in children whose current weight or rate of weight gain is much lower than that of other children of similar age and gender.

Q10: Assume there are routine inventory sales between

Q14: The balance sheet of the Ama,Bade,and Calli

Q14: On January 1,2011,Fly Corporation held a 60%

Q22: Match each of the following descriptions with

Q29: For each of the following transactions relating

Q33: Which pronouncements have the highest level of

Q33: Jefferson Company entered into a forward contract

Q36: On July 1,2011,when Salaby Company's total stockholders'

Q36: Chapter 7 bankruptcy cases differ from Chapter

Q126: A racemic mixture is an equal mixture