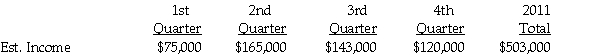

Nettle Corporation is preparing its first quarterly interim report.It is subject to a corporate income tax rate of 20% on the first $50,000 of taxable income and 35% on taxable income above $50,000.Its estimated pretax accounting income for 2011,by quarter,is:

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Required:

1.Determine Nettle's estimated effective tax rate for 2011.

2.Prepare a schedule to show Nettle's estimated net income for each quarter of 2011.

Definitions:

Prospective Country

A term potentially referring to a country viewed with regard to its future potential for development, investment, or growth.

Beaten Paths

Established methods or routines that have been widely used or explored, often implying a lack of innovation.

Home Country

Refers to the country where a company is headquartered or originates from.

Migration Behavior

The patterns or tendencies of individuals or groups to move from one location to another, often in search of better living conditions.

Q6: Palmquist Corporation and its 80%-owned subsidiary,Sadler Corporation,are

Q13: Patterson Company acquired 90% of Starr Corporation

Q16: Snackle Inc.is a 90%-owned subsidiary of Pasha

Q19: Several years ago,Pilot International purchased 70% of

Q20: In partnership liquidations,what are safe payments?<br>A)The amounts

Q20: What amount of total liabilities will be

Q24: Firms must conduct impairment tests more frequently

Q32: Pogo Corporation acquired a 75% interest in

Q62: The major product of the reaction of

Q175: Arenes undergo predominantly addition reactions.