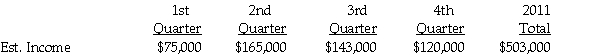

Nettle Corporation is preparing its first quarterly interim report.It is subject to a corporate income tax rate of 20% on the first $50,000 of taxable income and 35% on taxable income above $50,000.Its estimated pretax accounting income for 2011,by quarter,is:

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Required:

1.Determine Nettle's estimated effective tax rate for 2011.

2.Prepare a schedule to show Nettle's estimated net income for each quarter of 2011.

Definitions:

Note Receivable

A written promise to pay a specified amount of money, usually with interest, at a future date; it is recorded as an asset on the balance sheet.

Due Date

The specific date by which a payment must be made or a task must be completed.

Promissory Note

A written promise to pay a specified sum of money to a certain individual or entity at a specified date or on demand.

Face Amount

An amount at which bonds sell if the market rate equals the contract rate.

Q3: Required:<br>1.Prepare a schedule to allocate income to

Q3: Which of the following is not true?<br>A)A

Q19: Several years ago,Pilot International purchased 70% of

Q23: A parent company uses the equity method

Q23: Fill in the missing compounds or

Q24: Which type of fund is used to

Q28: The unadjusted trial balance for the general

Q30: Thoroughgood County has a municipal golf course

Q38: On September 1,2011,Beck Corporation acquired an 80%

Q66: A dichlorobenzene reacts with HNO<sub>3</sub>/H<sub>2</sub>SO<sub>4</sub> and produces