Note to Instructor: This exam item is similar to Exercise 3 except that the exchange rates have been changed and the temporal method is used instead of the current rate method.

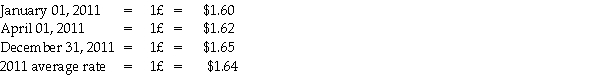

The Polka Corporation,a U.S.corporation,formed a British subsidiary on January 1,2011 by investing 550,000 British pounds (£)in exchange for all of the subsidiary's no-par common stock.The British subsidiary,Stripe Corporation,purchased real property on April 1,2011 at a cost of £500,000,with £100,000 allocated to land and £400,000 allocated to the building.The building is depreciated over a 40-year estimated useful life on a straight-line basis with no salvage value.The U.S.dollar is Stripe's functional currency,but it keeps its records in pounds.The British economy does not experience high rates of inflation.Exchange rates for the pound on various dates are:

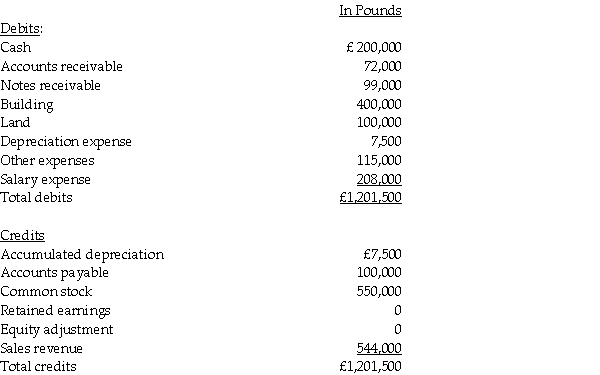

Stripe's adjusted trial balance is presented below for the year ended December 31,2011.

Stripe's adjusted trial balance is presented below for the year ended December 31,2011.

Required: Prepare Stripe's:

Required: Prepare Stripe's:

1.Remeasurement working papers;

2.Remeasured income statement;and

3.Remeasured balance sheet.

Definitions:

Torture

The act of inflicting severe physical or psychological pain on someone as a means of punishment, coercion, or obtaining information.

Israel

A country in the Middle East, established in 1948, known for its rich historical and cultural heritage as well as its ongoing geopolitical significance.

Targeted Assassinations

The premeditated killing of specific individuals, often for political, military, or ideological reasons, usually by governments or their agents.

CIA

The Central Intelligence Agency; a U.S. government agency responsible for foreign intelligence and covert operations.

Q10: A petition commencing a case against a

Q13: What goodwill will be recorded?<br>A)$ 80,000<br>B)$240,000<br>C)$320,000<br>D)$400,000

Q20: With respect to goodwill,an impairment<br>A)will be amortized

Q20: Astrotuff Company is planning to purchase 200,000

Q22: If a parent company and outside investors

Q27: When the donation of bonds is received,what

Q29: Griffon Incorporated holds a 30% ownership in

Q35: Platinum City collects state sales taxes quarterly

Q51: Oxidation of 2-propanol gives<br>A) acetaldehyde.<br>B) propanoic acid.<br>C)

Q55: Which of the following refers to