Piel Corporation (a U.S.company)began operations on January 1,2011,when common stock was issued for $250,000.In the first two months of operations,Piel had the following transactions:

January 15,2011 Bought inventory for 100,000 Mexican pesos on account

January 26,2011 Sold 70% of inventory acquired on 1/15/11 for 44,000 Saudi riyals on account

January 27,2011 Paid $1,000 in other operating expenses

February 2,2011 Sold additional inventory that cost $1,000 for $3,000 cash to a U.S.company.

February 15,2011 Acquired and paid the 100,000 pesos owed to the Mexican supplier

February 21,2011 Paid $1,500 in other operating expenses

February 28,2011 Collected the 44,000 riyals from the Saudi customer and immediately converted them into U.S.dollars

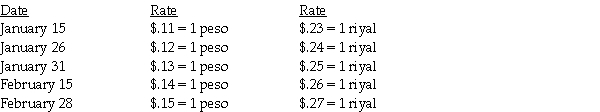

The following exchange rates apply:

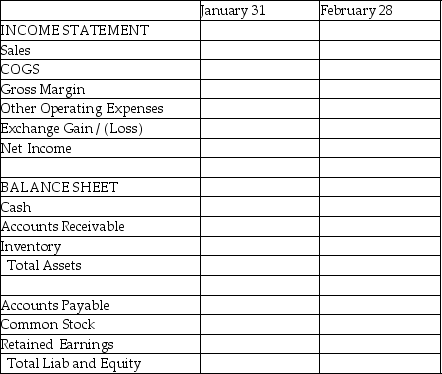

Required:

Required:

Complete the summary income statement and balance sheet for the month ended January 31,2011 and February 28,2011,assuming there were no other transactions.

Definitions:

Transplanted Tissues

Tissues moved from one body and placed into another, either in the same person or between individuals, to replace damaged or defective tissues.

Plasma Proteins

Proteins present in blood plasma, serving various functions such as clotting, defense against pathogens, and transportation of substances.

Lymphocyte Activation

The process by which lymphocytes (a type of white blood cell) are stimulated to respond to pathogens or other antigens.

Antigen-presenting Cells

Specialized immune cells that capture antigens and present them on their surface to T-cells, initiating an immune response.

Q11: Assume the entity theory is used.On January

Q12: Old West City had the following transactions

Q14: Pepper Company paid $2,500,000 for the net

Q21: Because a fund is an accounting entity,each

Q22: Cindy Lou's parents passed away while she

Q26: Under the entity theory,a consolidated balance sheet

Q28: Durer Inc.acquired Sea Corporation in a business

Q31: The unadjusted trial balance for the general

Q40: Under the entity theory,what amount of goodwill

Q165: Upon audit by the IRS,Faith is assessed