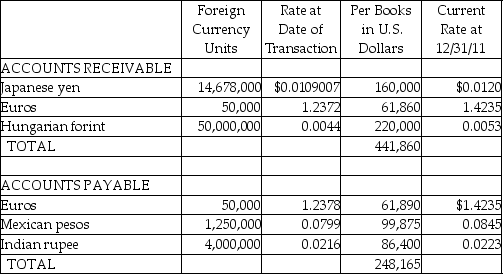

Lincoln Corporation,a U.S.manufacturer,both imports needed materials and exports finished products.Their receivables and payables are listed below,prior to year-end adjustments or preparation of the closing entries.

Required:

Required:

Determine the amount at which receivables and payables should be reported on December 31,2011,and the net exchange gain or loss that would be reported as a result of year-end adjustments.

Definitions:

Zygote

The 2n cell that results from the union of n gametes in sexual reproduction. Species that are not polyploid have haploid gametes and diploid zygotes.

Embryonic Cells

Cells derived from an embryo that have the potential to develop into any type of cell in the organism.

Crossing-Over

A process during meiosis where homologous chromosomes exchange genetic material, leading to new genetic combinations in offspring.

Genes

Units of heredity made up of DNA that code for the synthesis of proteins responsible for the organism's characteristics and functions.

Q11: Ohio Corporation is being liquidated under Chapter

Q15: The year-end balance sheet and residual profit

Q19: Under the Uniform Probate Code,the personal representative

Q20: On January 1,2011,Psalm Corporation purchased all the

Q20: Justice Corporation paid $40,000 cash for an

Q23: Which one of the following operating segment

Q27: What method of accounting will generally be

Q27: Pallet Corporation owns 80% of Adelt Corporation

Q32: Lincoln Corporation,a U.S.manufacturer,both imports needed materials and

Q88: A state income tax can be imposed