Meric Corporation (a U.S.company)began operations on January 1,2011,when the owner borrowed $150,000 to start the company.In the first month of operations,Meric had the following transactions:

January 3,2011 Bought inventory for 100,000 Brazilian real on account.Must be paid with Brazilian real.

January 8,2011 Sold 60% of inventory acquired on 1/3/11 for 32,000 British pounds on account.Invoice denominated in British pounds.

January 10,2011 Paid $3,000 in other operating expenses

January 23,2011 Acquired and paid half of the Brazilian real owed to the Brazilian supplier

January 28,2011 Collected half of the 32,000 pounds from the customer in Great Britain and immediately converted them into U.S.dollars

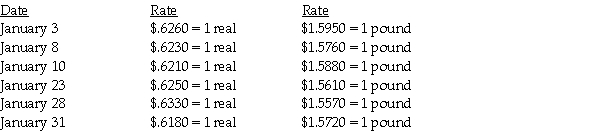

The following exchange rates apply:

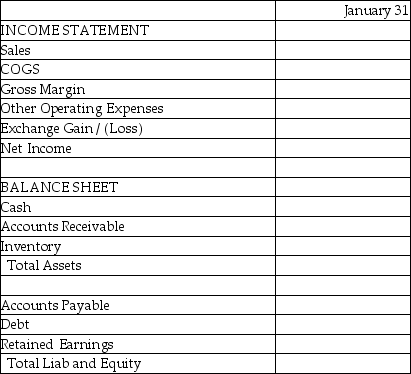

Required: Complete the summary income statement and balance sheet for the month ended January 31,2011 assuming there were no other transactions.

Required: Complete the summary income statement and balance sheet for the month ended January 31,2011 assuming there were no other transactions.

Definitions:

Performance Measures

Metrics used to assess the efficiency, effectiveness, and productivity of an individual, organization, or process.

Managers

Individuals in an organization responsible for directing and overseeing the work of a group of people.

Incentives

Benefits, rewards, or compensation offered to motivate specific actions or behaviors by individuals or organizations.

Q6: Palmquist Corporation and its 80%-owned subsidiary,Sadler Corporation,are

Q13: When performing a consolidation,if the balance sheet

Q16: On January 2,2011 Piron Corporation issued 100,000

Q24: On January 1,2011,Penny Company acquired a 90%

Q31: A nongovernmental,not-for-profit entity is subject to: I.GASB<br>II)FASB<br>A)I

Q31: If SOS sold the additional shares to

Q37: A simple partnership liquidation requires<br>A)periodic payments to

Q37: What is the reported amount for the

Q38: John Doe's will states that all assets

Q113: In preparing a tax return,all questions on