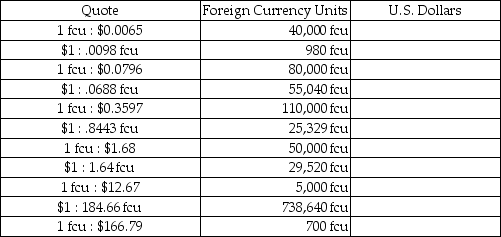

The table below provides either a direct or indirect quote for a given foreign currency unit,and the related units of that foreign currency.

Required:

Required:

Complete the table,indicating the amount of U.S.Dollars that is the equivalent of the foreign currency shown,based on the direct or indirect quote provided.

Definitions:

Federal Income Tax

The tax levied by the U.S. federal government on the annual earnings of individuals, corporations, trusts, and other legal entities.

State Unemployment Tax

A tax that employers are required to pay to their state government to fund unemployment benefits for workers who have lost their jobs.

Payroll Tax Expense

This refers to the taxes that an employer is responsible for paying on behalf of its employees, which generally include social security and Medicare taxes.

FICA Taxes Payable

Taxes owed by an employer, employee, or both, to the Federal Insurance Contributions Act for Social Security and Medicare.

Q1: A small town in a rural area

Q9: On January 1,2011,Persona Company acquired 80% of

Q12: Old West City had the following transactions

Q14: A U.S.parent corporation loans funds to a

Q15: Samantha's Sporting Goods had net assets consisting

Q18: At December 31,2012 year-end,Arnold Corporation's investment in

Q21: Crabby Industries,a U.S.corporation,purchased inventory from a company

Q24: In reference to international accounting for goodwill,U.S.companies

Q33: A parent company uses the equity method

Q190: The first income tax on individuals (after