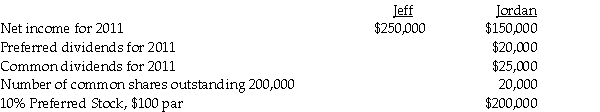

Jeff Corporation owns 90% of the common stock of Subsidiary Jordan.The following data is available:

The preferred stock is cumulative and convertible.The annual preferred dividends are $20,000.

The preferred stock is cumulative and convertible.The annual preferred dividends are $20,000.

Required:

1.Jordan's preferred stock is convertible into 20,000 shares of Jordan's common stock.Jeff and Jordan do not have any other potentially dilutive securities outstanding.

a.What is Jordan's basic EPS and diluted EPS?

b.What is consolidated basic EPS and diluted EPS?

2.Jordan's preferred stock is convertible into 20,000 shares of Jeff's common stock.Jeff and Jordan do not have any other potentially dilutive securities outstanding.What is consolidated basic EPS and diluted EPS?

Definitions:

Start-up Costs

The initial expenses required to start a new business, including costs for legal fees, equipment, inventory, and marketing.

Skill Levels

The degrees of proficiency or competence in performing tasks or jobs, often categorized by beginner, intermediate, and advanced levels.

Skill-based Pay

Skill-based pay is a compensation system where employees are paid based on the number, variety, or complexity of skills and qualifications they possess, rather than solely on their job position or title.

Additional Pay

Compensation above an employee's regular pay scale, which could include bonuses, overtime, or allowances.

Q1: On January 1,2011,Jeff Company acquired a 90%

Q4: At December 31,2010,the stockholders' equity of Gost

Q6: Palmquist Corporation and its 80%-owned subsidiary,Sadler Corporation,are

Q9: Petra Corporation paid $500,000 for 80% of

Q13: Candy Corporation paid $240,000 on April 1,2011

Q24: On January 2,2011,PBL Enterprises purchased 90% of

Q32: Pali Corporation exchanges 200,000 shares of newly

Q55: In late June 2015,Art is audited by

Q126: The Federal gas-guzzler tax applies only to

Q144: Because the law is complicated,most individual taxpayers