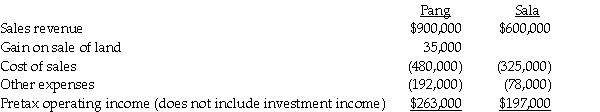

Pretax operating incomes of Pang Corporation and its 70%-owned subsidiary,Sala Corporation,for the year 2011,are shown below.Sala pays total dividends of $60,000 for the year.There are no unamortized book value/fair value differentials relating to Pang's investment in Sala.During the year,Pang sold land to Sala for a gain of $35,000 and Sala holds this land at the end of the year.The marginal corporate tax rate for both corporations is 34%.

Required:

Required:

1.Determine the separate amounts of income tax expense for Pang and Sala as if they had filed separate tax returns.

2.Determine Pang's net income from Sala.

Definitions:

Little Albert

An experiment conducted by John B. Watson and Rosalie Rayner demonstrating classical conditioning by inducing a phobic response in an infant.

Behaviorism

A field of psychology that focuses on observable behaviors rather than on mental processes, and posits that all behaviors are learned through interaction with the environment.

Basic Conditioning Principles

The foundational rules of learning through association, including classical and operant conditioning, which explain how behaviors are acquired or modified.

Heredity

Heredity is the transmission of traits and characteristics from parents to offspring through genes, influencing various aspects of an individual's physical appearance and behavior.

Q4: Petrol Company acquired an 90% interest in

Q11: A Federal excise tax is no longer

Q12: General Hospital is a private,not-for-profit hospital.The following

Q18: What basis of accounting is used by

Q21: On July 1,2011,Joe,Kline,and Lama began a partnership

Q24: On January 1,2011,Penny Company acquired a 90%

Q30: On January 2,2012,Pal Corporation sold warehouse equipment

Q32: Pogo Corporation acquired a 75% interest in

Q34: Pyming Corporation accounts for its 40% investment

Q122: The value added tax (VAT) has not