Use the following information to answer the question(s) below.

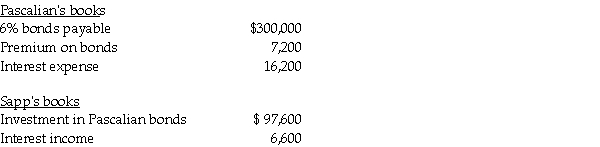

Pascalian Company owns a 90% interest in Sapp Company.On January 1,2010,Pascalian had $300,000,6% bonds outstanding with an unamortized premium of $9,000.The bonds mature on December 31,2014.Sapp acquired one-third of Pascalian's bonds in the open market for $97,000 on January 1,2010.Both companies use straight-line amortization of bond discounts/premiums.Interest is paid on December 31.On December 31,2010,the books of the two affiliates held the following balances:

-Prussia Corporation owns 80% the voting stock of Stad Corporation.On January 1,2010,Prussia paid $391,000 cash for $400,000 par of Stad's 10% $1,000,000 par value outstanding bonds,due on April 1,2015.Stad's bonds had a book value of $1,045,000 on January 1,2010.Straight-line amortization is used.The gain or loss on the constructive retirement of $400,000 of Stad bonds on January 1,2010 was reported in the 2010 consolidated income statement in the amount of

Definitions:

Positive Net Present Value

An indicator that an investment is expected to generate more cash than the initial amount invested, viewed positively in capital budgeting.

Regular Dividend

A fixed amount paid by a company to its shareholders out of its profits (or reserves) on a regular schedule.

Dividend Policy

A company's approach to distributing profits back to its shareholders in the form of dividends.

Reverse Stock Split

A business move that reduces the total number of current stock shares, making the remaining shares more valuable on a proportional basis.

Q5: Required:<br>1.Prepare a schedule to allocate income or

Q9: Paco Corporation owns 90% of Aber Corporation,Aber

Q13: Gains and losses incurred at liquidation are

Q15: Paulee Corporation paid $24,800 for an 80%

Q18: Plateau Incorporated bought 60% of the common

Q22: Consolidated cost of goods sold for Pelga

Q22: Creditors of the partnership may seek the

Q24: The City of Attross entered the following

Q36: In the Uniform Partnership Act,partners have I.mutual

Q38: What is the amount of consolidated Retained