Use the following information to answer the question(s) below.

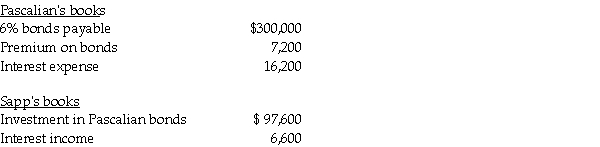

Pascalian Company owns a 90% interest in Sapp Company.On January 1,2010,Pascalian had $300,000,6% bonds outstanding with an unamortized premium of $9,000.The bonds mature on December 31,2014.Sapp acquired one-third of Pascalian's bonds in the open market for $97,000 on January 1,2010.Both companies use straight-line amortization of bond discounts/premiums.Interest is paid on December 31.On December 31,2010,the books of the two affiliates held the following balances:

-Consolidated Interest Expense and consolidated Interest Income,respectively,that appeared on the consolidated income statement for the year ended December 31,2010 was

Definitions:

Interest Rate

The cost of borrowing money, typically expressed as an annual percentage of the principal amount.

Payments

Transactions that involve the transfer of money from one party to another, often in exchange for goods or services.

Mutual Fund

An investment vehicle that pools money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities.

Deposit

A sum of money placed into a bank account or with a financial institution as a part of a transaction or for safekeeping.

Q6: When preparing consolidated financial statements,which of the

Q13: Match each of the following fund types

Q17: On January 1,2011,Gregory Company acquired a 90%

Q18: Pregler Inc.has 70% ownership of Sach Company,but

Q19: Utah Company holds 80% of the stock

Q22: What is the total amount for the

Q23: Bailey's noncontrolling interest share for 2011 is<br>A)$7,609.<br>B)$8,044.<br>C)$15,652.<br>D)$23,696.

Q26: If the sale of the merchandise was

Q37: On June 1,2011,Dapple Industries purchases an option

Q38: On July 1,2011,Piper Corporation issued 23,000 shares