Use the following information to answer the question(s) below.

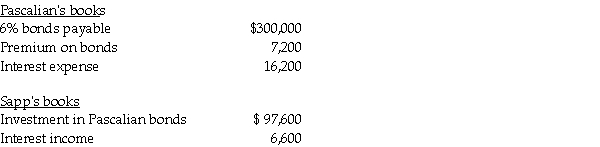

Pascalian Company owns a 90% interest in Sapp Company.On January 1,2010,Pascalian had $300,000,6% bonds outstanding with an unamortized premium of $9,000.The bonds mature on December 31,2014.Sapp acquired one-third of Pascalian's bonds in the open market for $97,000 on January 1,2010.Both companies use straight-line amortization of bond discounts/premiums.Interest is paid on December 31.On December 31,2010,the books of the two affiliates held the following balances:

-Prussia Corporation owns 80% the voting stock of Stad Corporation.On January 1,2010,Prussia paid $391,000 cash for $400,000 par of Stad's 10% $1,000,000 par value outstanding bonds,due on April 1,2015.Stad's bonds had a book value of $1,045,000 on January 1,2010.Straight-line amortization is used.The gain or loss on the constructive retirement of $400,000 of Stad bonds on January 1,2010 was reported in the 2010 consolidated income statement in the amount of

Definitions:

Employer

An individual or entity that hires and pays for the services of employees.

Religious Accommodation

Arrangements made by an employer so that employees can do their jobs and practise their faith at the same time.

Christian Presence

The existence or participation of Christian beliefs, practices, or influences in a specific area or social context.

Media Attention

The focus or coverage that media outlets give to specific events, individuals, or topics.

Q3: What funds are reported in Government-wide financial

Q6: Pachelor Corporation owns 70% of the outstanding

Q10: The following are transactions for the city

Q11: On January 1,2010,Petrel,Inc.purchased 70% of the outstanding

Q19: The XYZ partnership provides a 10% bonus

Q21: Under GAAP,the _ will include the variable

Q23: Bailey's noncontrolling interest share for 2011 is<br>A)$7,609.<br>B)$8,044.<br>C)$15,652.<br>D)$23,696.

Q34: How much cash must Oran invest to

Q34: The following are transactions for the city

Q107: A deduction for certain expenses (interest and