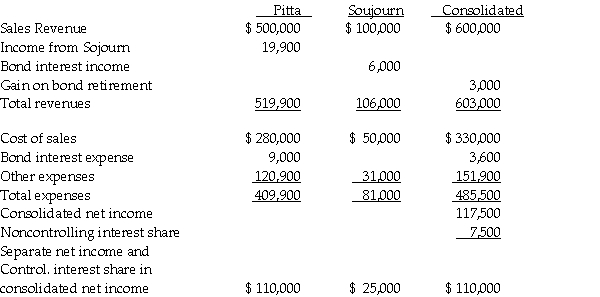

Separate company and consolidated income statements for Pitta and Sojourn Corporations for the year ended December 31,2011 are summarized as follows:

The interest income and expense eliminations relate to a $100,000,9% bond issue that was issued at par value and matures on January 1,2016.On January 2,2011,a portion of the bonds was purchased and constructively retired.

The interest income and expense eliminations relate to a $100,000,9% bond issue that was issued at par value and matures on January 1,2016.On January 2,2011,a portion of the bonds was purchased and constructively retired.

Required: Answer the following questions.

1.Which company is the issuing affiliate of the bonds payable?

2.What is the gain or loss from the constructive retirement of the bonds payable that is reported on the consolidated income statement for 2011?

3.What portion of the bonds payable is held by nonaffiliates at December 31,2011?

4.Is Sojourn a wholly-owned subsidiary? If not,what percentage does Pitta own?

5.Does the purchasing affiliate use straight-line or effective interest amortization?

6.Explain the calculation of Pitta's $19,900 income from Sojourn.

Definitions:

Average Interitem Correlations

A statistic used to measure the consistency of responses among related items on a questionnaire or test, indicating the scale's internal reliability.

Reliability Estimate

A statistical measure that quantifies the consistency of a set of measurements or ratings.

Validity

The extent to which a concept, conclusion, or measurement is well-founded and corresponds accurately to the real world.

Construct

A hypothetical variable that is used to explain behavior in theories and models within the psychological and social sciences.

Q2: The book value of the partnership equity

Q6: If a U.S.company is preparing a journal

Q12: Pane Corporation owns 100% of Alder Corporation,85%

Q18: The tax law provides various tax credits,deductions,and

Q23: A summary balance sheet for the Sissy,Jody,and

Q28: On May 1,2011,Listing Corporation receives inventory items

Q40: The balance sheet of the Addy,Bess,and Clara

Q60: In connection with facilitating the function of

Q63: One of the major reasons for the

Q137: A safe and easy way for a