Use the following information to answer the question(s) below.

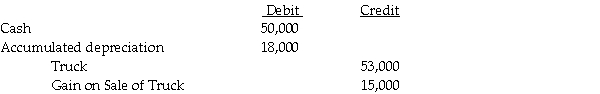

On January 1,2010,Shrimp Corporation purchased a delivery truck with an expected useful life of five years,and a salvage value of $8,000.On January 1,2012,Shrimp sold the truck to Pacet Corporation.Pacet assumed the same salvage value and remaining life of three years used by Shrimp.Straight-line depreciation is used by both companies.On January 1,2012,Shrimp recorded the following journal entry:

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

-In the eliminating/adjusting entries on consolidation working papers for 2012,the Truck account was

Definitions:

Modeling

A behavioral learning technique whereby individuals learn by observing and imitating others.

Social Learning

A theory that suggests individuals learn new behaviors and information by observing and imitating others, emphasizing the importance of cognitive processes in learning from the social environment.

Gestalt Psychologists

Psychologists who focus on human perception and cognitive processes, emphasizing the idea that the whole of anything is greater than its parts.

Behavioral

Pertaining to the actions or reactions of a person or animal in response to external or internal stimuli.

Q4: If conditions produce a debit balance in

Q5: Required:<br>1.Prepare a schedule to allocate income or

Q9: A Federal deduction for state and local

Q15: Pied Imperial Corporation acquired a 90% interest

Q19: A primary difference between voluntary and involuntary

Q22: Jeale Corporation is preparing its interim financial

Q24: Paula's Pizzas purchased 80% of their supplier,Sarah's

Q29: Which of the following hedging strategies would

Q32: On November 1,2011,Ross Corporation,a calendar-year U.S.corporation,invested in

Q78: What administrative release deals with a proposed