Use the following information to answer the question(s) below.

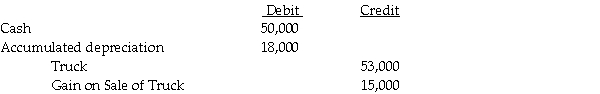

On January 1,2010,Shrimp Corporation purchased a delivery truck with an expected useful life of five years,and a salvage value of $8,000.On January 1,2012,Shrimp sold the truck to Pacet Corporation.Pacet assumed the same salvage value and remaining life of three years used by Shrimp.Straight-line depreciation is used by both companies.On January 1,2012,Shrimp recorded the following journal entry:

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

-Assume an upstream sale of machinery occurs on January 1,2011.The parent owns 70% of the subsidiary.There is a gain on the intercompany transfer and the machine has five remaining years of useful life and no salvage value.Straight-line depreciation is used.Which of the following statements is correct?

Definitions:

High-Low Method

An accounting technique used to estimate the fixed and variable components of a cost based on the highest and lowest activity levels.

Least-Squares Regression

A statistical method used to determine the line of best fit by minimizing the sum of the squares of the vertical distances of the points from the line.

Least-Squares Regression

A statistical method used to determine the best-fitting line through a set of points, minimizing the sum of the squares of the distances of the points from the line.

Statistical Evidence

Data collected and analyzed for the purpose of supporting a conclusion or hypothesis.

Q4: For 2010,2011,and 2012,Squid Corporation earned net incomes

Q20: Astrotuff Company is planning to purchase 200,000

Q22: On November 1,2011,Moddel Company (a U.S.corporation)entered into

Q25: Pabari Corporation owns an 80% interest in

Q28: Which one of the following operating segment

Q38: What is a Technical Advice Memorandum?

Q48: The granting of a Writ of Certiorari

Q115: Even though a client refuses to correct

Q150: Briana lives in one state and works

Q151: Which,if any,is not one of Adam Smith's