Plower Corporation acquired all of the outstanding voting common stock of the Squab Corporation several years ago when the book values and fair values of Squab's net assets were equal.

On April 1,2010,Plower sold land that cost $25,000 to Squab for $40,000.Squab resold the land for $45,000 on December 1,2012.

On July 1,2012,Plower sold equipment with a book value of $10,000 to Squab for $26,000.Squab is depreciating the equipment over a four-year period using the straight-line method.The equipment has no salvage value.

Required:

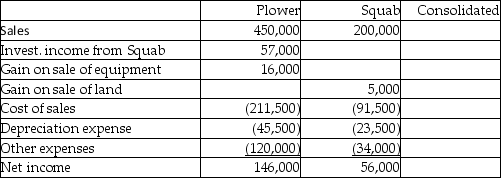

The first two columns in the working papers presented below summarize income statement information from the separate company financial statements of Plower and Squab for the year ended December 31,2012.Fill in the consolidated working paper columns to show how each of the items from the separate company reports will appear in the consolidated income statement for the year ended December 31,2012.

Definitions:

Service Factor

A measure used in inventory control and logistics planning to determine the safety stock level required to meet a predetermined level of service.

Negative Exponential Distribution

A type of statistical distribution often used to model the time between independent events that happen at a constant average rate.

Average Arrival Rate

In queuing theory, the average number of units (customers, items, etc.) arriving at a service point or system per unit time.

Q9: Petra Corporation paid $500,000 for 80% of

Q11: If the partnership agreement provides a formula

Q19: Utah Company holds 80% of the stock

Q24: In a schedule of assumed loss absorptions<br>A)the

Q25: Which one of the following will increase

Q33: Assume a company's preferred stock is cumulative

Q34: The partnership of Georgia,Holly,and Izzy was dissolved,and

Q39: Selvey Inc.is a wholly-owned subsidiary of Parsfield

Q125: On his 2015 income tax return,Andrew omitted

Q128: Mona inherits her mother's personal residence,which she