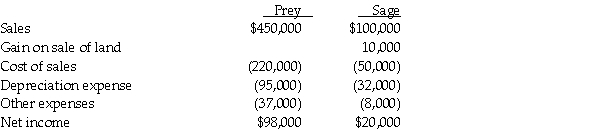

Prey Corporation created a wholly owned subsidiary,Sage Corporation,on January 1,2010,at which time Prey sold land with a book value of $90,000 to Sage at its fair market value of $140,000.Also,on January 1,2010,Prey sold to Sage equipment with a book value of $130,000 and a selling price of $165,000.The equipment had a remaining useful life of 4 years and is being depreciated under the straight-line method.The equipment has no salvage value.On January 1,2012,Sage resold the land to an outside entity for $150,000.Sage continues to use the equipment purchased from Prey.Income statements for Prey and Sage for the year ended December 31,2012 are summarized below:

Required:

Required:

At what amounts did the following items appear on the consolidated income statement for Prey and Subsidiary for the year ended December 31,2012?

1.Gain on Sale of Land

2.Depreciation Expense

3.Consolidated net income

4.Controlling interest share of consolidated net income

Definitions:

Jean-Paul Sartre

A French philosopher, playwright, novelist, and political activist from the 20th century, recognized for his work in existentialism and phenomenology.

Relationships

The way in which two or more people or things are connected, or the state of being connected.

Conflict

A struggle or clash between opposing forces, ideas, or interests, either internally within a person or externally between individuals, groups, or nations.

Thomas Nagel

An American philosopher known for his contributions to philosophy of mind, political philosophy, and ethics, particularly famous for the essay "What Is It Like to Be a Bat?".

Q2: The amount of income for the current

Q6: The partnership of Dolla,Earl,and Festus was dissolved

Q6: A summary balance sheet for the Uma,Van,and

Q14: Papal Corporation acquired an 80% interest in

Q15: On January 1,2005,Myna Corporation issued 10,000 shares

Q26: On January 2,2011,Paogo Company sold a truck

Q35: At the beginning of 2011,Parling Food Services

Q73: Tax brackets are increased for inflation.

Q90: A tax credit for amounts spent to

Q154: More than 25% gross income omission and