Use the following information to answer the question(s) below.

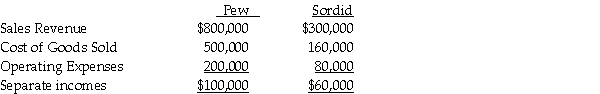

Pew Corporation acquired 80% ownership of Sordid Incorporated,at a time when Pew's investment cost was equal to 80% of Sordid's book value.At the time of acquisition,the book values and fair values of Sordid's assets and liabilities were equal.Pew uses the equity method.During 2011,Pew sold goods to Sordid for $160,000 making a gross profit percentage of 20%.Half of these goods remained unsold in Sordid's inventory at the end of the year.Income statement information for Pew and Sordid for 2011 were as follows:

-The 2011 consolidated income statement showed noncontrolling interest share of

Definitions:

Unliquidated Debt

A debt for which the exact monetary value has not been determined.

Consideration

Something of value exchanged between parties in a contract, required for the agreement to be legally binding.

Liquidated Debt

A debt for which the amount owed is known and agreed upon by both parties.

Liquidated Debt

A debt for which the exact monetary value has been determined and acknowledged by both the debtor and creditor.

Q3: Parker Corporation owns an 80% interest in

Q4: If conditions produce a debit balance in

Q7: The acquisition of treasury stock by a

Q14: Plum Corporation paid $700,000 for a 40%

Q19: The balance sheet of the Park,Quid,and Reggie

Q30: On January 1,2011,Wrobel Company acquired a 90

Q31: Which of the following sources has the

Q35: Parrot Incorporated purchased the assets and liabilities

Q59: Determination letters usually involve finalized transactions.

Q111: In terms of revenue neutrality,comment on a