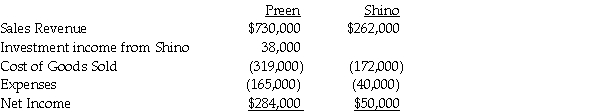

Preen Corporation acquired a 60% interest in Shino Corporation at a cost equal to 60% of the book value of Shino's net assets in 2010.At the time of acquisition,the book value and fair value of Shino's assets and liabilities were equal.During 2011,Preen sold $120,000 of merchandise to Shino.All intercompany sales are made at 150% of Preen's cost.Shino's beginning and ending inventories resulting from intercompany sales for 2011 were $60,000 and $36,000,respectively.Income statement information for both companies for 2011 is as follows:

Required:

Required:

Prepare a consolidated income statement for Preen Corporation and Subsidiary for 2011.

Definitions:

Latent Content

The underlying meaning or symbolism of a dream or subconscious thought, as opposed to its literal content.

Therapist's Interpretations

Insights or explanations provided by a therapist about a patient's condition or behaviors, often used to assist in treatment planning.

Latent Content

The hidden psychological meaning of dreams, going beyond the literal storyline to uncover deeper symbolic significance.

Psychodynamic

An approach in psychology that emphasizes the systematic study of the psychological forces that underlie human behavior, feelings, and emotions and how they might relate to early experience.

Q5: The exchange rates between the Australian dollar

Q7: Peel Corporation acquired a 80% interest in

Q14: The balance sheet of the Ama,Bade,and Calli

Q21: On January 1,2011,Bosna borrowed $100,000 from Lenda.The

Q24: When preparing their year-end financial statements,the Warner

Q35: Pancake Corporation saw the potential for vertical

Q71: If a taxpayer decides not to pay

Q92: Due to the population change,the Goose Creek

Q118: The objective of pay-as-you-go (paygo) is to

Q139: Currently,the tax base for the Social Security