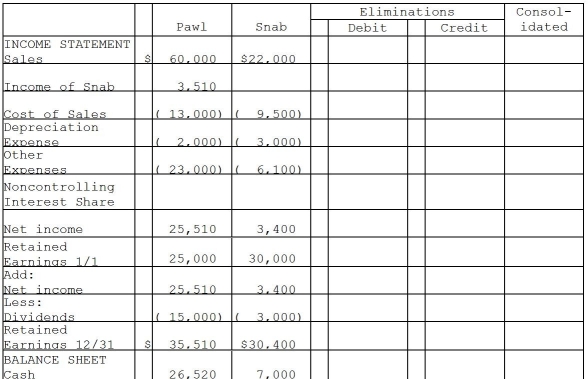

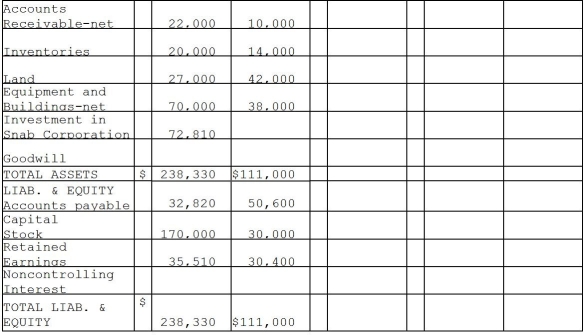

Pawl Corporation acquired 90% of Snab Corporation on January 1,2011 for $72,000 cash when Snab's stockholders' equity consisted of $30,000 of Capital Stock and $30,000 of Retained Earnings.The difference between the fair value of Pawl's assets and liabilities and the book value was allocated to a plant asset with a remaining 10-year straight-line life that was overvalued on the books by $5,000.The remainder was attributable to goodwill.The separate company statements for Pawl and Snab appear in the first two columns of the partially completed consolidation working papers.

Required:

Complete the consolidation working papers for Pawl and Snab for the year 2011.

Definitions:

Q3: Packo Company acquired all the voting stock

Q4: Peyton Corporation owns an 80% interest in

Q7: Peel Corporation acquired a 80% interest in

Q8: According to FASB Statement 141R,which one of

Q11: Piel Corporation (a U.S.company)began operations on January

Q21: Perry Instruments International purchased 75% of the

Q34: Tax planning usually involves a completed transaction.

Q39: Drawings<br>A)are advances to a partnership.<br>B)are loans to

Q51: Katelyn is divorced and maintains a household

Q97: Stealth taxes are directed at lower income