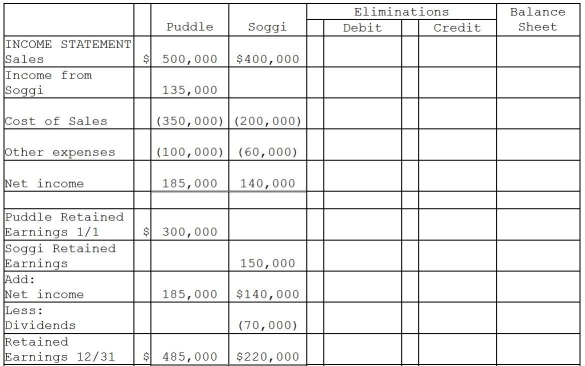

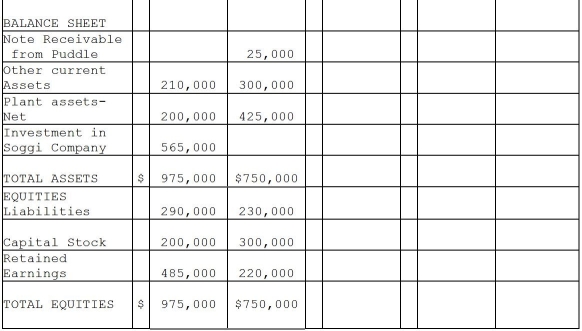

Puddle Corporation acquired all the voting stock of Soggi Company for $500,000 on January 1,2011 when Soggi had Capital Stock of $300,000 and Retained Earnings of $150,000.The book value of Soggi's assets and liabilities were equal to the fair value except for the plant assets.The entire cost-book value differential is allocated to plant assets and is fully depreciated on a straight-line basis over a 10-year period.

During 2011,Puddle borrowed $25,000 on a short-term non-interest-bearing note from Soggi,and on December 31,2011,Puddle mailed a check to Soggi to settle the note.Soggi deposited the check on January 5,2012,but receipt of payment of the note was not reflected in Soggi's December 31,2011 balance sheet.

Required:

Complete the consolidation working papers for the year ended December 31,2011.

Definitions:

Technology

The application of scientific knowledge for practical purposes, especially in industry.

U.S. Constitution

The supreme law of the United States that outlines the nation's fundamental principles and establishes its governmental framework.

Privacy

Refers to the right of individuals to keep their personal information out of public view and to have control over their own personal data.

Fourth Amendment

Part of the U.S. Constitution protecting citizens from unwarranted searches and seizures by the government.

Q3: Salli Corporation regularly purchases merchandise from their

Q13: Note to Instructor: This exam item is

Q21: In the consolidated income statement of Wattlebird

Q34: Cass Corporation's balance sheet at December 31,2011

Q38: What is the weighted-average capital for Bertram

Q44: The ad valorem tax on personal use

Q57: In terms of probability,which of the following

Q101: In determining whether the gross income test

Q123: Two months after the burglary of his

Q188: A bribe to the local sheriff,although business