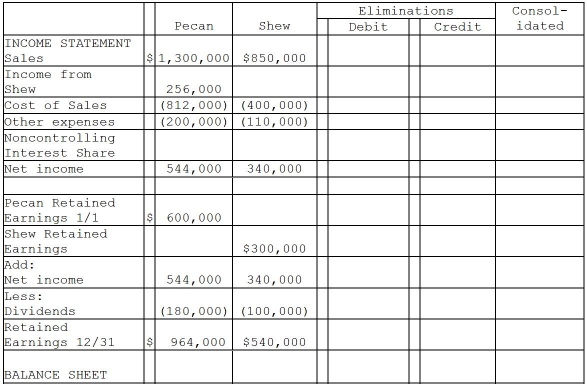

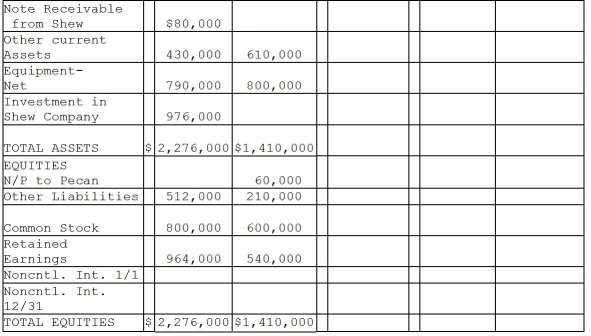

Pecan Incorporated acquired 80% of the voting stock of Shew Manufacturing for $800,000 on January 2,2011 when Shew had outstanding common stock of $600,000 and Retained Earnings of $300,000.The book value and fair value of Shew's assets and liabilities were equal except for equipment.The entire fair value/book value differential is allocated to equipment and is fully depreciated on a straight-line basis over a 5-year period.

During 2011,Shew borrowed $80,000 on a short-term non-interest-bearing note from Pecan,and on December 31,2011,Shew mailed a check for $20,000 to Pecan in partial payment of the note.Pecan deposited the check on January 4,2012,and recorded the entry to reduce the note balance at that time.

Required:

Complete the consolidation working papers for the year ended December 31,2011.

Definitions:

Canalization

The tendency for a trait that is biologically programmed to be restricted to only a few outcomes.

Range of Reaction

A theory suggesting that genetic potential sets certain limits on the expression of traits, but the environment determines where within those limits an individual will fall.

Epigenesis

The process through which the genotype interacts with the environment to guide development, affecting gene expression without altering the DNA sequence.

Passive Correlation

A statistical relationship between two variables where changes in one variable occur alongside but are not directly caused by changes in the other.

Q2: Austin contributes his computer equipment to the

Q7: Subsequent to an acquisition,the parent company and

Q19: Historically,much of the controversy concerning accounting requirements

Q22: What exchange gain or loss appeared on

Q30: A subsidiary has dilutive securities outstanding that

Q31: For the tax year 2015,Noah reported gross

Q34: Psalm Enterprises owns 90% of the outstanding

Q36: A tax cut enacted by Congress that

Q156: Excise tax on tobacco

Q172: Fraud and statute of limitations