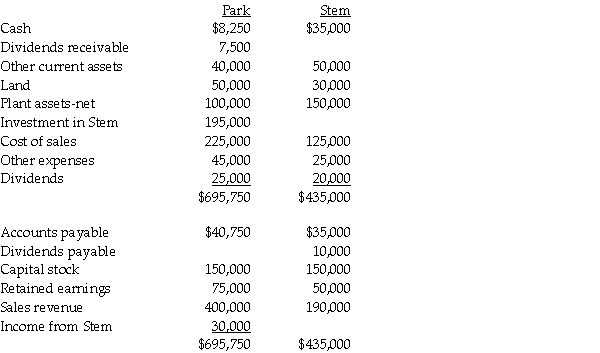

Park Corporation paid $180,000 for a 75% interest in Stem Co.'s outstanding Capital Stock on January 1,2011,when Stem's stockholders' equity consisted of $150,000 of Capital Stock and $50,000 of Retained Earnings.Book values of Stem's net assets were equal to their fair values on this date.The adjusted trial balances of Park and Stem on December 31,2011 were as follows:

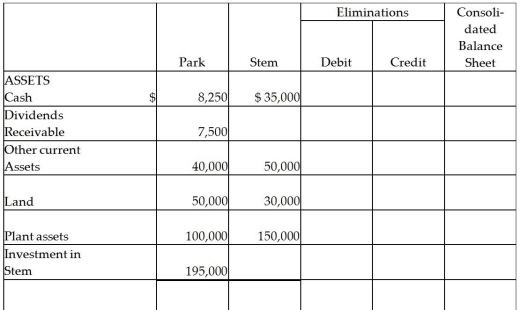

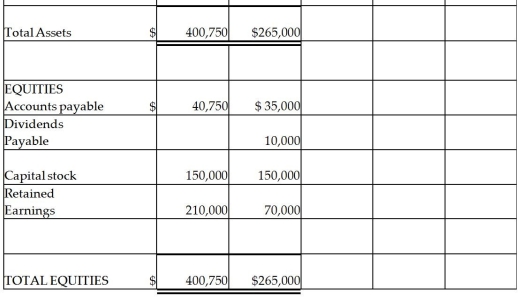

Required: Complete the partially prepared consolidated balance sheet working papers that appear below.

Required: Complete the partially prepared consolidated balance sheet working papers that appear below.

Definitions:

Great Depression

A severe worldwide economic crisis that took place during the 1930s, marked by massive unemployment and widespread poverty.

Matching Grant

A funding arrangement where a grant is given on the condition that an equal amount is matched from another source.

Nullification Theory

A legal theory suggesting that U.S. states have the right to nullify, or invalidate, any federal law which they deem unconstitutional.

Dual Federalism

A political arrangement in which power is divided between federal and state governments in clearly defined terms, with state governments exercising those powers accorded to them without interference from the federal government.

Q1: Stilt Corporation purchased a 40% interest in

Q3: If Bird uses the "actual-sale-date" sales assumption,its

Q21: On January 1,2011,Bosna borrowed $100,000 from Lenda.The

Q22: A lack of compliance in the payment

Q28: On January 1,2011 Paki Inc.bought 75% interest

Q29: Similar operating segments may be combined if

Q31: For the tax year 2015,Noah reported gross

Q39: Peter Corporation owns a 70% interest in

Q120: After her divorce,Hope continues to support her

Q150: All exclusions from gross income are reported