Use the following information to answer the question(s) below.

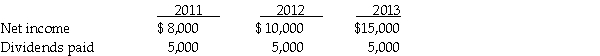

On January 1,2011,Pansy Company acquired a 10% interest in Sunflower Corporation for $80,000 when Sunflower's stockholders' equity consisted of $400,000 capital stock and $100,000 retained earnings.Book values of Sunflower's net assets equaled their fair values on this date.Sunflower's net income and dividends for 2011 through 2013 were as follows:

-Jacana Corporation paid $200,000 for a 25% interest in Lilypad Corporation's common stock on January 1,2010,but was not able to exercise significant influence over Lilypad.During 2011,Jacana reported income of $120,000,excluding its income from Lilypad,and paid dividends of $50,000.Lilypad reported net income of $40,000 during 2011 and paid dividends of $20,000.Jacana should report net income for 2011 in the amount of

Definitions:

Operating Fund

A fund used to cover the day-to-day operational expenses of an organization.

Capital Fund

A reserve of capital that can be used for specific purposes, often to fund long-term investment projects or to cover future liabilities.

Restricted Fund Method

An accounting principle used by non-profit organizations, where donations or grants are kept in separate accounts and are spent only according to donors' stipulations.

Capital Fund

A financial resource that is used for the purchase of fixed assets or for significant investment in a business, not consumed in normal operations.

Q1: On January 1,2011,Jeff Company acquired a 90%

Q13: Note to Instructor: This exam item is

Q22: Park Corporation paid $180,000 for a 75%

Q27: Pallet Corporation owns 80% of Adelt Corporation

Q28: Note to Instructor: This exam item is

Q32: Paradise Corporation owns 100% of Aldred Corporation,90%

Q39: Clara,age 68,claims head of household filing status.If

Q85: Many taxpayers who previously itemized will start

Q122: The value added tax (VAT) has not

Q180: A CPA firm in California sends many