Use the following information to answer the question(s) below.

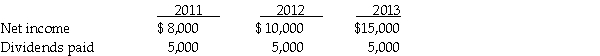

On January 1,2011,Pansy Company acquired a 10% interest in Sunflower Corporation for $80,000 when Sunflower's stockholders' equity consisted of $400,000 capital stock and $100,000 retained earnings.Book values of Sunflower's net assets equaled their fair values on this date.Sunflower's net income and dividends for 2011 through 2013 were as follows:

-Jacana Corporation paid $200,000 for a 25% interest in Lilypad Corporation's common stock on January 1,2010,but was not able to exercise significant influence over Lilypad.During 2011,Jacana reported income of $120,000,excluding its income from Lilypad,and paid dividends of $50,000.Lilypad reported net income of $40,000 during 2011 and paid dividends of $20,000.Jacana should report net income for 2011 in the amount of

Definitions:

Superior Oblique

A cranial muscle that moves the eyeball downward and outward, involved in rotary movements of the eye.

Superior Rectus

A muscle in the eye that primarily enables upward movement of the eyeball.

Inferior Rectus

A muscle in the eye that controls downward movement of the eyeball.

Superior Rectus

A muscle in the human eye, which is responsible for elevating the eye and turning it inward.

Q1: On January 1,2011,Jeff Company acquired a 90%

Q6: Three judges will normally hear each U.S.Tax

Q20: Gains or losses on foreign currency transactions

Q21: Sales made by mail order are not

Q22: What exchange gain or loss appeared on

Q30: On January 1,2011,Wrobel Company acquired a 90

Q30: If an affiliate purchases bonds in the

Q38: Phlora purchased its 100% ownership in Speshal

Q53: State and local governments are sometimes forced

Q76: A taxpayer who loses in a U.S.District