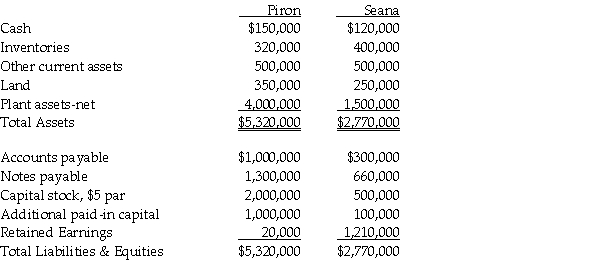

On January 2,2011 Piron Corporation issued 100,000 new shares of its $5 par value common stock valued at $19 a share for all of Seana Corporation's outstanding common shares.Piron paid $15,000 to register and issue shares.Piron also paid $20,000 for the direct combination costs of the accountants.The fair value and book value of Seana's identifiable assets and liabilities were the same.Summarized balance sheet information for both companies just before the acquisition on January 2,2011 is as follows:

Required:

Required:

1.Prepare Piron's general journal entry for the acquisition of Seana,assuming that Seana survives as a separate legal entity.

2.Prepare Piron's general journal entry for the acquisition of Seana,assuming that Seana will dissolve as a separate legal entity.

Definitions:

Business Goals

Objectives or targets that a company aims to achieve, which can be short-term or long-term, and are part of strategic planning.

Vulnerabilities

Weaknesses or gaps in a system's security that can be exploited to cause harm or unauthorized access.

Bank Reconciliation

The process of matching and comparing figures from the accounting records against those presented on a bank statement.

Safe Deposit Box

A secure container, usually found in banks or financial institutions, used for storing valuable possessions or documents.

Q10: Olson Corporation paid $62,000 to acquire 100%

Q12: Arizona is in the jurisdiction of the

Q16: A subsidiary can be excluded from consolidation

Q24: When preparing their year-end financial statements,the Warner

Q24: The basic and additional standard deductions both

Q26: Under the entity theory,a consolidated balance sheet

Q36: Following the accounting concept of a business

Q38: The additional standard deduction for age and

Q73: Tax brackets are increased for inflation.

Q169: Under state amnesty programs,all delinquent and unpaid