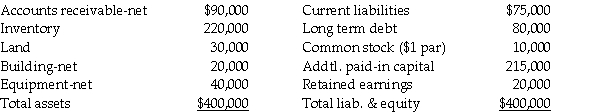

Bigga Corporation purchased the net assets of Petit,Inc.on January 2,2011 for $380,000 cash and also paid $15,000 in direct acquisition costs.Petit,Inc.was dissolved on the date of the acquisition.Petit's balance sheet on January 2,2011 was as follows:

Fair values agree with book values except for inventory,land,and equipment,which have fair values of $260,000,$35,000 and $35,000,respectively.Petit has patent rights with a fair value of $20,000.

Fair values agree with book values except for inventory,land,and equipment,which have fair values of $260,000,$35,000 and $35,000,respectively.Petit has patent rights with a fair value of $20,000.

Required:

Prepare Bigga's general journal entry for the cash purchase of Petit's net assets.

Definitions:

Money

Money is a medium of exchange in the form of coins and banknotes; by which goods and services are valued and exchanged.

Present Value

The current financial value of money or cash flows that will be obtained in the future, factored by a particular rate of return.

Annuity

An economic device offering a steady series of disbursements to someone, commonly utilized as a financial support for retired individuals.

Market Rate

The prevailing rate at which a particular good, service, or asset is bought and sold in a free market.

Q13: What should be the noncontrolling interest share,preferred

Q32: Spott is a 75%-owned subsidiary of Penthal.On

Q38: Pascal Corporation paid $225,000 for a 70%

Q44: There are 11 geographic U.S.Circuit Court of

Q62: Brayden files his Federal income tax return

Q85: A Revenue Ruling is a judicial source

Q97: Stealth taxes are directed at lower income

Q132: Some states use their state income tax

Q190: The first income tax on individuals (after

Q193: On transfers by death,the Federal government relies