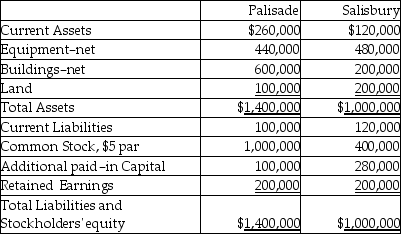

The balance sheets of Palisade Company and Salisbury Corporation were as follows on December 31,2010:

On January 1,2011 Palisade issued 30,000 of its shares with a market value of $40 per share in exchange for all of Salisbury's shares,and Salisbury was dissolved.Palisade paid $20,000 to register and issue the new common shares.It cost Palisade $50,000 in direct combination costs.Book values equal market values except that Salisbury's land is worth $250,000.

On January 1,2011 Palisade issued 30,000 of its shares with a market value of $40 per share in exchange for all of Salisbury's shares,and Salisbury was dissolved.Palisade paid $20,000 to register and issue the new common shares.It cost Palisade $50,000 in direct combination costs.Book values equal market values except that Salisbury's land is worth $250,000.

Required:

Prepare a Palisade balance sheet after the business combination on January 1,2011.

Definitions:

Total Cost

The complete sum of all costs associated with producing or acquiring goods and services, including direct, indirect, fixed, and variable costs.

Responsiveness

The ability of a system or organization to quickly and effectively react to changes.

Carrier

A company that provides transportation services for goods, typically via land, sea, or air.

Mode of Transportation

Refers to the various methods or forms used to move people or goods from one place to another, such as by road, rail, air, or sea.

Q4: If the bonds were originally issued at

Q5: On June 1,2011,Puell Company acquired 100% of

Q13: When performing a consolidation,if the balance sheet

Q31: For the tax year 2015,Noah reported gross

Q35: A forward contract used as a cash

Q60: Ralph purchased his first Series EE bond

Q64: What statement is not true with respect

Q84: A parent employs his twin daughters,age 17,in

Q110: The Dargers have itemized deductions that exceed

Q185: Under the Federal income tax formula for