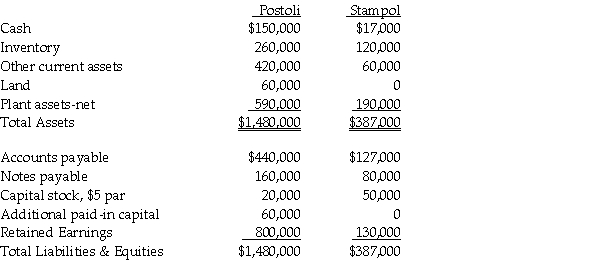

On June 30,2011,Stampol Company ceased operations and all of their assets and liabilities were purchased by Postoli Incorporated.Postoli paid $40,000 in cash to the owner of Stampol,and signed a five-year note payable to the owners of Stampol in the amount of $200,000.Their closing balance sheets as of June 30,2011 are shown below.In the purchase agreement,both parties noted that Inventory was undervalued on the books by $10,000,and Pistoli would also take possession of a customer list with a fair value of $18,000.Pistoli paid all legal costs of the acquisition,which amounted to $7,000.

Required:

Required:

1.Prepare the journal entry Postoli would record at the date of acquisition.

2.Prepare the journal entry Stampol would record at the date of acquisition.

Definitions:

Per Capita Real GDP

A measure of the average economic output per person, adjusted for inflation, in a given country.

GDP Deflator

An indicator for the pricing levels of all new, domestically produced, consumable goods and services within an economy.

Population

The total number of people living in a specific area or country at a given time.

Net Domestic Product

The sum of the market value of all domestically produced goods and services in a country during a given time period, subtracting the loss in value from depreciation.

Q2: Pike Corporation paid $100,000 for a 10%

Q5: On June 1,2011,Puell Company acquired 100% of

Q6: Under parent company theory,noncontrolling interest is valued

Q11: Piel Corporation (a U.S.company)began operations on January

Q17: Assume that Penguin sold the additional 3,000

Q27: Separate income statements of Pingair Corporation and

Q40: Shebing Corporation had $80,000 of $10 par

Q78: What administrative release deals with a proposed

Q141: Average income tax rate

Q156: In terms of timing as to any