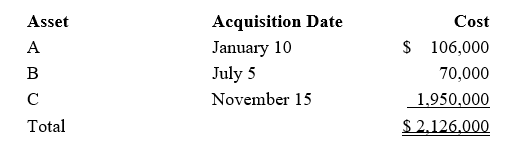

Audra acquires the following new five-year class property in 2016:

Audra elects § 179 treatment for Asset C.Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction.Audra claims the full available additional first-year depreciation deduction.Determine her total cost recovery deduction (including the § 179 deduction)for the year.

Definitions:

Higher-Order Conditioning

A process in behavioral psychology where a stimulus that initially has no significance comes to elicit a response after being associated with a stimulus that already elicits that response.

Stimulus Generalization

The tendency for the conditioned response to be elicited by stimuli that are similar but not identical to the conditioned stimulus.

Auditory Stimulation

The process of using sound to evoke a response in the auditory system.

Tactile Stimulation

The process of stimulating the sense of touch, often used in therapy and child development to promote sensory integration and emotional well-being.

Q8: Sue has unreimbursed expenses.

Q9: Edna had an accident while competing in

Q39: The key date for calculating cost recovery

Q62: Zack was the beneficiary of a life

Q69: Discuss the tax consequences of listed property

Q80: Letha incurred a $1,600 prepayment penalty to

Q88: If the amount of the insurance recovery

Q100: Maria,who owns a 50% interest in a

Q130: The Code does not specifically define what

Q177: After the automatic mileage rate has been