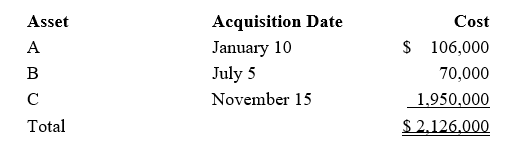

Audra acquires the following new five-year class property in 2016:

Audra elects § 179 treatment for Asset C.Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction.Audra claims the full available additional first-year depreciation deduction.Determine her total cost recovery deduction (including the § 179 deduction)for the year.

Definitions:

Culturally and Linguistically Diverse

Refers to communities or individuals that come from a variety of cultural and language backgrounds, emphasizing the richness and diversity of their experiences.

Instructional Discourse

Involves communication that facilitates learning and education, typically occurring in academic settings between teachers and students.

Educational Practices

Methods, policies, and approaches used in the process of imparting knowledge or facilitating learning in an educational setting.

Q3: Mia participated in a qualified state tuition

Q27: Joe,who is in the 33% tax bracket

Q54: Any § 179 expense amount that is

Q68: Green,Inc. ,provides group term life insurance for

Q73: In 2016,Linda incurs circulation expenses of $240,000

Q86: Howard's business is raising and harvesting peaches.On

Q92: During the current year,Ralph made the following

Q99: Dan contributed stock worth $16,000 to his

Q113: Are all personal expenses disallowed as deductions?

Q117: Sue files a Form 2106 with her