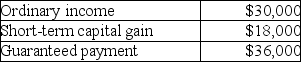

Brent is a limited partner in BC Partnership.His distributive share of partnership income and his guaranteed payment for the year are as follows:  What is his self-employment income?

What is his self-employment income?

Definitions:

Breathing

The process of inhaling and exhaling air, facilitating the exchange of gases (oxygen and carbon dioxide) in the respiratory system.

Dead

A state of biological cessation where an organism no longer exhibits any signs of life or metabolic activity.

Necessary Condition

A condition that must be present for an event or entity to occur or exist.

Birthday

The anniversary of the day on which a person was born, typically celebrated as an annual event.

Q17: Guo,Lev and Zhou (2005)find that several

Q18: Identify which of the following statements is

Q27: If the SPI futures contract is

Q32: In the current year,Pearl Corporation has $300,000

Q37: By the end of the 1990s,private equity

Q38: When computing the partnership's ordinary income,a deduction

Q45: The Supreme Court has held that literal

Q54: Yong contributes a machine having an adjusted

Q67: A consolidated NOL carryover is $52,000 at

Q83: Tax-exempt interest income on state and local