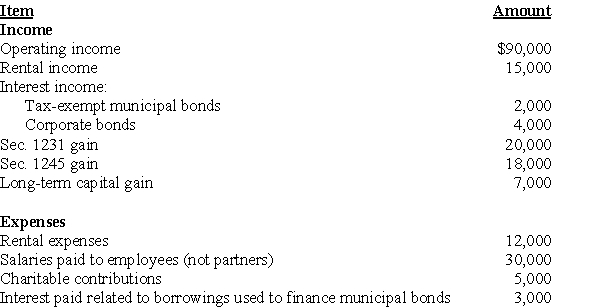

The WE Partnership reports the following items for its current tax year:

What is the WE Partnership's ordinary income for the current year?

What is the WE Partnership's ordinary income for the current year?

Definitions:

Diabetic Foot Ulcers

Diabetic Foot Ulcers are chronic sores that occur on the feet of people with diabetes, often due to neuropathy, poor circulation, and infection risk, requiring careful management.

Diabetic Glaucoma

A condition where an individual with diabetes develops glaucoma, often due to increased pressure in the eye that damages the optic nerve.

Type 1 DM

A chronic condition where the pancreas produces little or no insulin, often termed Type 1 Diabetes Mellitus.

Pseudo-Cushing's Syndrome

A condition that mimics the symptoms of Cushing's syndrome, such as obesity and high cortisol levels, but without the presence of a cortisol-producing tumor.

Q1: An equity-linked deposit is a zero coupon

Q2: All else the same,an American style option

Q6: The interest coverage ratio is calculated as:<br><br>A)

Q37: Tactical asset allocation does not involve the

Q49: Which of the following statements is true?<br>A)

Q52: Given the following information about Jones Corporation,what

Q53: Identify which of the following statements is

Q57: Hope Corporation was liquidated four years ago.Teresa

Q95: American Corporation acquires the noncash assets of

Q112: Identify which of the following increases Earnings