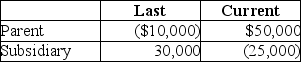

Parent and Subsidiary Corporations form an affiliated group.Last year,the initial year of operation,Parent and Subsidiary filed separate returns.This year,the group files a consolidated tax return.The results for last year and the current year are: Taxable Income How much of Subsidiary's loss can be carried back to last year?

How much of Subsidiary's loss can be carried back to last year?

Definitions:

Compensation Data

Information regarding the range of pay rates, salaries, and benefits offered to employees in various positions within an industry.

Labour Exceeds

This phrase might refer to situations where the available workforce or effort put into a task surpasses what is necessary or expected, potentially leading to inefficiencies.

Informal Surveys

Non-structured methods of gathering data or feedback, often used for quick or preliminary assessments.

Central Tendency

A statistical measure that identifies the center of a data distribution, often used in performance appraisals to describe a tendency to rate employees near an average level.

Q2: The NOL deduction is calculated the same

Q12: Which type of fund has the objective

Q12: Blueboy Inc.contributes inventory to a qualified charity

Q23: Tax attributes of the target corporation are

Q36: You have $1250 000 invested in a

Q39: When a subsidiary corporation is liquidated into

Q54: Identify which of the following statements is

Q56: Identify which of the following statements is

Q57: Hope Corporation was liquidated four years ago.Teresa

Q68: Identify which of the following statements is